SENATORS JILL CARTER, BRAD HUDSON, AND RICK BRATTIN ALL VOTED FOR CORPORATE WELFARE FOR BILLIONAIRES. WHY DID THEY TAKE A BAD VOTE AND WHAT THEY ARE TELLING THEIR CONSTITUENTS.

SB 3 deals with these major issues:

#1: COLLEGIATE AND AMATEUR SPORTING EVENTS. (Sections 67.3000 and 67.3005)

#2. SHOW-ME SPORTS INVESTMENT ACT (Section 100.240)

This act creates the "Show-Me Sports Investment Act". The Office of Administration and the Department of Economic Development are authorized to expend funds for the purpose of aiding and cooperating in the planning, undertaking, financing, or carrying out of an athletic and entertainment facility project.

#3: TAX CREDIT FOR HOMESTEAD DAMAGE (Section 135.445)

For all tax years beginning on or after January 1, 2025, this act authorizes a taxpayer to claim a tax credit in an amount not to exceed $5,000 for the insurance deductible incurred by the taxpayer during the 2025 calendar year as a direct result of a disaster for which a request for a presidential disaster declaration has been made by the Governor.

#4: PROPERTY TAX CREDIT

This act requires certain counties to place on the ballot by no later than the April 2026 general election a question of whether to grant a property tax credit to eligible taxpayers residing in such county. Eligible taxpayers are defined as residents who: 1) are the owner of record of or have a legal or equitable interest in a homestead; and 2) are liable for the payment of real property taxes on such homestead.

SEVERABILITY CLAUSE

This act contains a severability clause. (Section B)

FIRST: NO SUBSTITUTE BILL SHOULD BE ABLE TO BE DROPPED AT 2:00am, perfected and third read all in one setting. When done this way there is NO time to review the bill, or the fiscal note with enough information and intelligence reviewing the bill to fully understand the implications. This should never happen when it comes to a bill that interprets to potential BILLIONS of dollars coming from the state of Missouri (which means from tax payers).

Below is the fiscal analysis of this bill. Click below to read in full.

When a substitute bill is dropped at 2:00 am, there is not enough staff in the building or in their offices to make an accurate stab at the fiscal note of a bill. This is why you should not be able to substitute a bill in the wee hours of the morning and be expected to perfect that bill and third read it all in one very quick setting. But, here we are. That is how this Missouri Senate operates under the current leadership. NO TIME TO REVIEW in a meaningful way.

There were THREE versions presented in one night. Look at all three and on the first page you will see that in the third version (presented at around 2:00 am) something very important was added to the bill…the serverability clause.

You will hear people say that every bill is severable. Yes, to some degree that is true. However, you will note with this final version highlights an explicit severability clause, which is fairly rare. This tells the courts that the general assembly knows the courts might throw out a particular provision of this bill (in a way this provision is saying “courts we expect you to remove a certain portion of the bill) and the INTENT OF THE GENERAL ASSEMBLY is to let the other parts of the bill stand if the court does choose to strike the portion in question out of the bill.

A NON SEVERABILITY CLAUSE would mean that if the courts struck out one portion of the bill then the WHOLE bill dies. THAT is clearly not what was done here. Why? We will get into that a little later. (Listen to the podcast and understand the strategy at play here.)

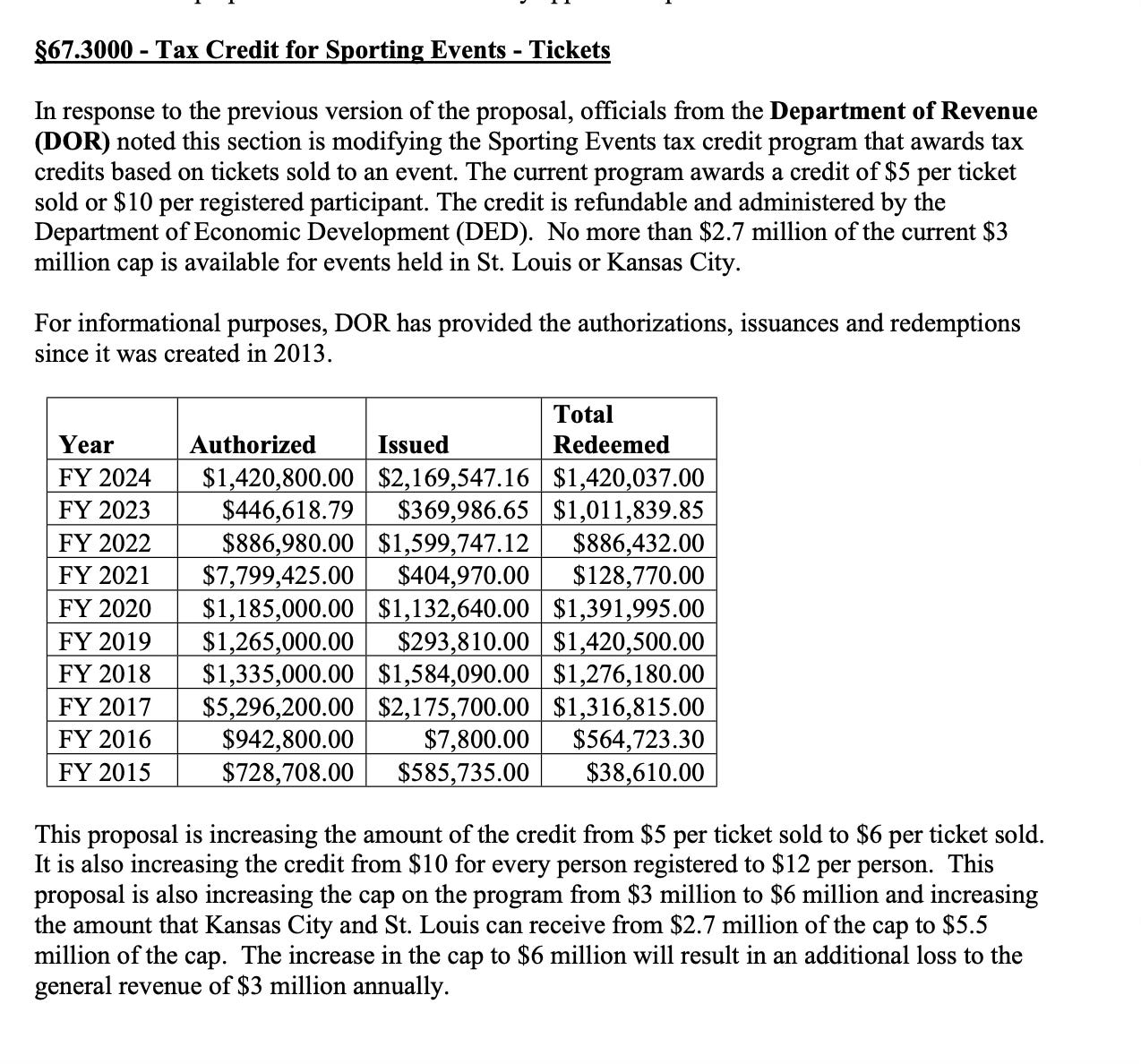

#1: COLLEGIATE AND AMATEUR SPORTING EVENTS. (Sections 67.3000 and 67.3005)

The act requires an applicant to submit a ticket sales or box office statement, or a list of registered participants, rather than documentation of eligible costs.

The amount of the tax credit shall be equal to either $6 for every admission ticket sold, rather than $5, or $12 for every registered participant, rather than $10. The Department of Revenue shall issue a refund of the tax credit within 90 days of the applicant's submission of a valid tax credit certificate, even prior to the close of the tax year for which the tax credits are issued.

This act extends the sunset on the tax credit from August 28, 2025, to August 28, 2032. (Section 67.3000)

Current law also authorizes a tax credit in the amount of 50% of an eligible donation made to a certified sponsor or local organizing committee, with the total annual amount of such tax credits limited to $10 million. This act reduces such allowable annual amount of tax credits to $500,000. This act also extends the sunset on such tax credit from August 28, 2025, to August 28, 2032. (Section 67.3005)

Fiscal portion for this section of the bill:

#2. SHOW-ME SPORTS INVESTMENT ACT (Section 100.240)

SECTION 100.240 brings in the KC CHIEFS AND ROYALS LANGUAGE (CLICK TO READ AND REFERENCE PAGE 12)

This act creates the "Show-Me Sports Investment Act". The Office of Administration and the Department of Economic Development are authorized to expend funds for the purpose of aiding and cooperating in the planning, undertaking, financing, or carrying out of an athletic and entertainment facility project.

Did you see that? Expend state funds that belong to the tax payers, aiding means a myriad of things all involving $$$$, undertaking with $$$, financing is self explanatory. This is how your state summary explains this section of the bill.

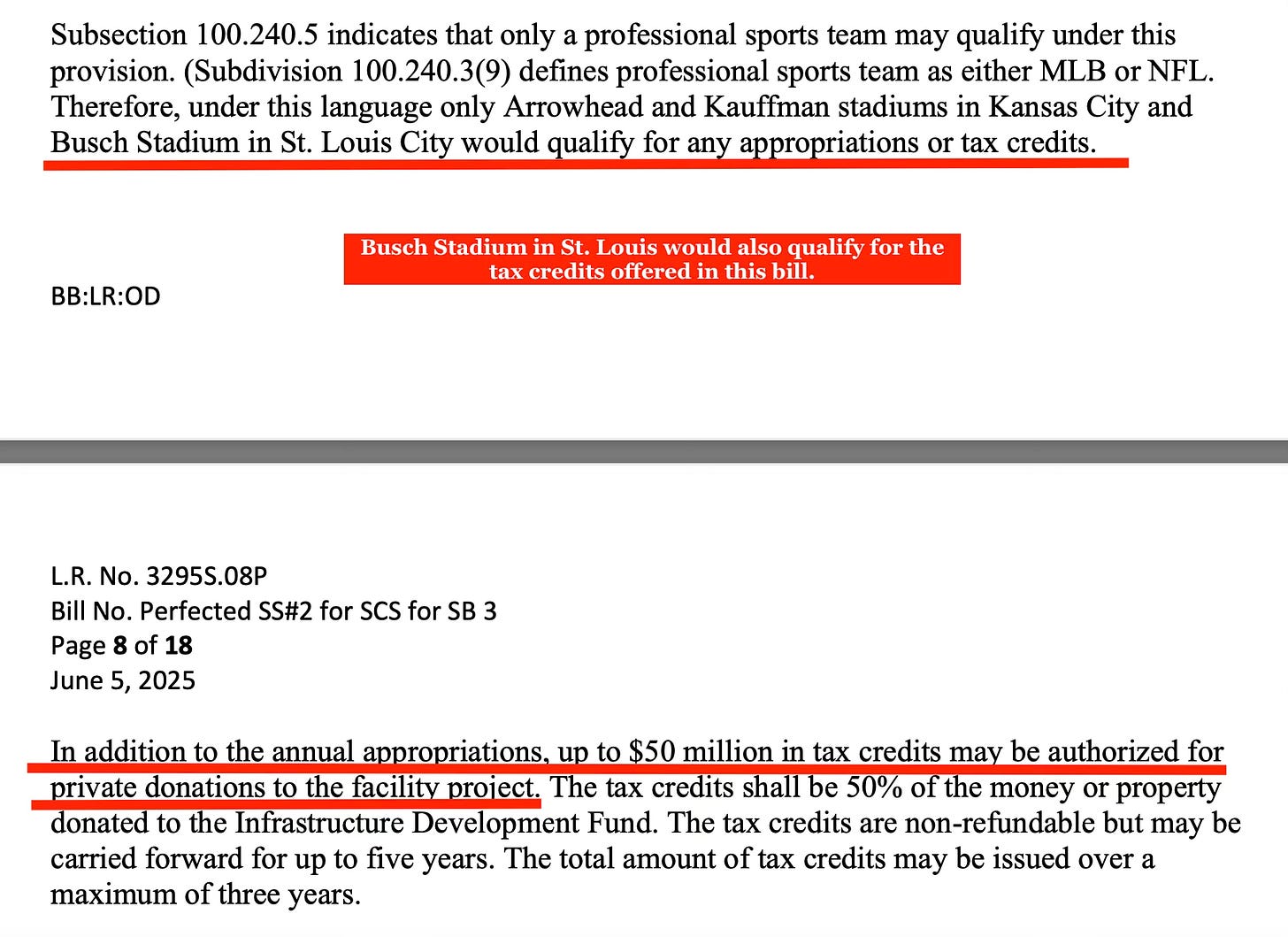

BUSCH STADIUM IN ST. LOUIS IS INCLUDED IN THIS LANGUAGE.

IN ADDITION TO ANNUAL APPROPRIATIONS….AN ADDITIONAL $50 MILLION PER YEAR IS ALLOWED IN TAX CREDITS FROM “PRIVATE DONATIONS”. (Does anyone even know what that means?)

IN ADDITION TO ANNUAL APPROPRIATIONS FOR THE TEAMS KC CHIEFS, KC ROYALS, AND ST. LOUIS CARDINALS…ANOTHER $50 MILLION PER YEAR IS ALLOWED IN PRIVATE DONATIONS IN THE FORM OF TAX CREDITS PER STADIUM?

What is the “INFRASTRUCTURE DEVELOPMENT FUND”?

FROM THE FISCAL NOTE PORTION OF THE BILL REVIEW:

In response to the previous version, officials from the Department of Economic Development (DED) assumed §100.240 creates the Show-Me Sports Investment Act, a program administered by the Department of Economic Development. This program, subject to appropriation, is created to aid and cooperate in the planning, undertaking, financing, or carrying out of an athletic and entertainment facility project for which application is made to the Department.

NOTE: (from above): This program, subject to appropriation, is created to aid and cooperate in the planning, undertaking, financing, or carrying out of an athletic and entertainment facility project for which application is made to the Department.

NOTE: (from the fiscal review): Oversight notes that the athletic and entertainment facility project could potentially receive up to two different incentives, such as direct state aid for bonds and tax credits.

THE STATE WILL BE FUNDING POTENTIALLY THREE PROJECTS…KC ROYALS, KC CHIEFS, AND ST. LOUIS CARDINALS (if they apply). There will be direct state aid in the form of bonds and tax credits for both the project and PRIVATE INVESTORS.

NOTE: Oversight notes, for informational purposes, that according to the recent annual report the Chief Organization remitted $40,245,223 million in direct and indirect tax for 2023 tax year. (Source: Jackson County Sports Complex Authority, 2024 Annual Report, page 20 - https://www.jcsca.org/legaldocuments)

INTERPRETATION: This amount of tax revenue will no longer be contributed to the state of Missouri. This is a credit that the professional sports teams will keep in their pockets to “build or improve their stadiums”. This means less revenue collected for the operations of our state (which just passed the largest budget in history at $53.5 BILLION) from massive corporations associated with this bill. This means it is unlikely that the tax payers of Missouri will see any true tax relief any time in the future. Someone has to pay for the budget in Missouri.

#3: TAX CREDIT FOR HOMESTEAD DAMAGE (Section 135.445)

The Governor did a dirty here. He is wrapping his stadium bill around tax relief for people in distress. This is probably the dirtiest part of what they do. For people truly suffering, he throws them a crumb. He gives them a measly $5000 to rebuild their lives. BILLIONS TO CORPORATE WELFARE. PENNIES TO THOSE IN OUR STATE WHO NEED IT THE MOST.

How do you vote against disaster relief? This is where Cindy O’Laughlin is so gross. When she addresses this bill she makes it sound like it is for victims of storm damage. THAT IS NOT TRUE. THIS BILL IS ABOUT CORPORATE WELFARE with a smidge going to help those in our state who are suffering the most. It is interesting that when she posts on her FB page she turns off comments on anything she thinks the public may challenge her on.

Notice…the bill would help poor Missourians who lost everything due to storm damage. She does not tell you the state is only giving them a “tax credit” to the tune of $5000 to help rebuild their lives.

The original bill would also help cure cancer. Funding for Nuclear research did not make it, but it was a #2 priority of the bill.

She does not tell you that the investment of $1 billion is likely for three teams, and that investment is largely being funded and paid for on the backs of Missourians. Cindy O shrouds her truth in these truths and designates this as “economic development”.

Lastly, Cindy O. acts as if the bill will help Missouri tax payers seek relief on their real estate taxes. She knows the severability clause is meant for this portion of the bill. This will be fought in court and she knows it. It will be “severed” due to the way it was written at 2:00 A.M. and voted out the door. Had the bill had time for true review the next day, many attorneys and legal scholars could have easily shown the pitfalls in the language of the bill drafted in the wee hours of the morning. Cindy knows that. The Governor knows that. That is why they do these kinds of bills at 2:00 a.m. in the Missouri Senate.

Their attitude: Let them eat cake.

#4: PROPERTY TAX CREDIT (You really need to listen to the podcast to understand how disappointing this part of the night became.)

Joe Nicola has been a champion for the people of Jackson County where they have used AI to re-assess the taxes in that part of the state. 55,000 residents have appealed for relief due to the fact many tax payers have seen over quadruple increases in their taxes.

Joe Nicola ran for senate to seek relief for the people of his district. His district has always been his priority.

Senator Nicola has been the person talking about tax relief when it comes to real estate taxes all session. In recent weeks the whole state has been jolted awake due to new Memorandums forced upon the assessors of Missouri to raise taxes wildly across Missouri or the STC will withhold all sales tax revenue for any county that did not sign on to the edicts of the State Tax Commission.

He had an amendment that he was offering for real estate tax relief. It grew to include many counties in Missouri, but not all. Only certain senators requested to offer relief to all Missourians. Many senators did not want their counties included for real estate relief.

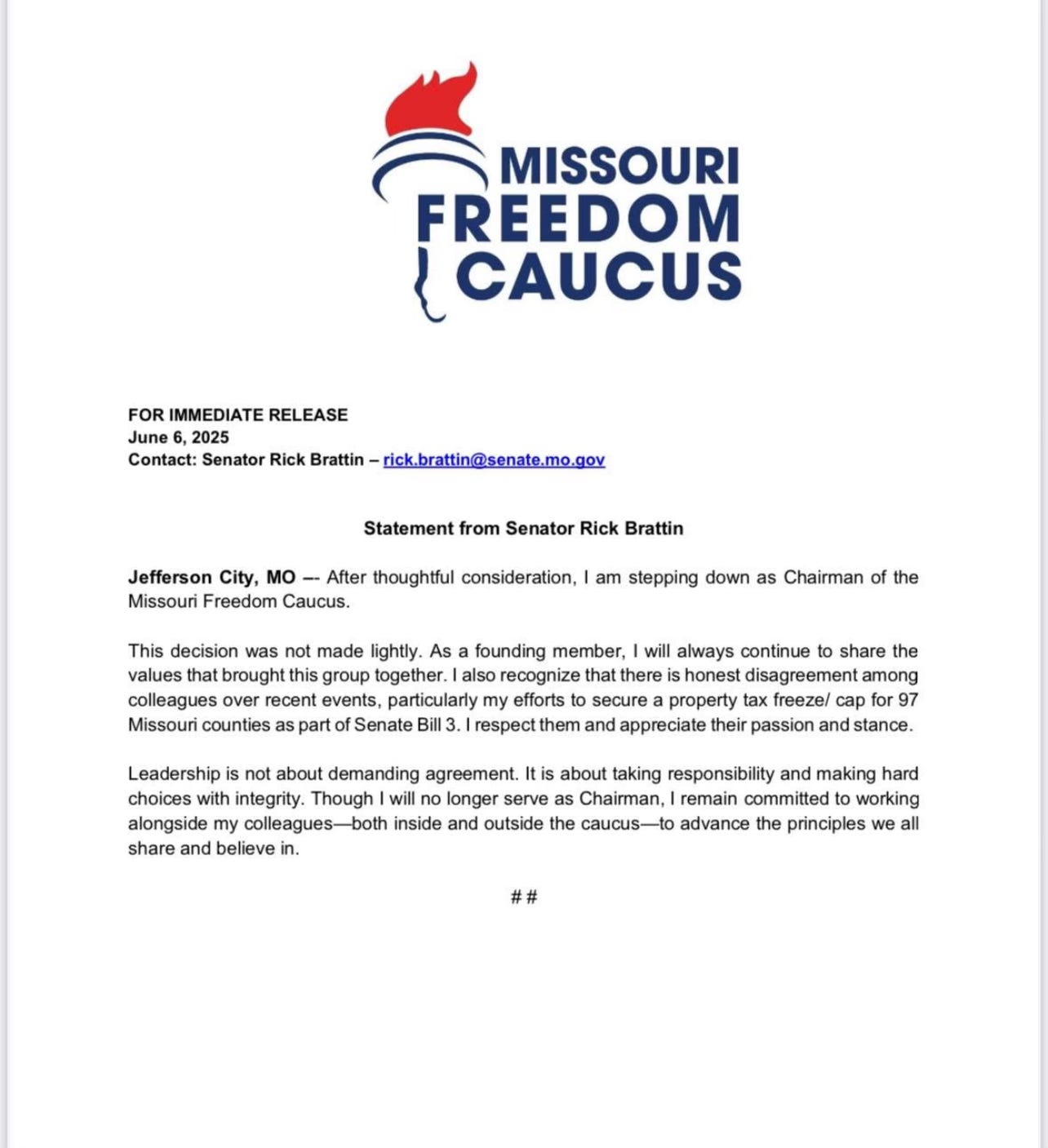

Negotiations were taking place in back rooms that did not include Senator Nicola. Freedom Caucus Chair, Rick Brattin, was negotiating the “tax relief portion of the bill” in those darkest hours before the dawn.

The first sub was laid over and A NEW THIRD VERSION WAS BROUGHT TO THE FLOOR. IN THAT VERSION, RICK BRATTIN REMOVED JACKSON COUNTY FROM ANY TAX RELIEF IN HIS BACK ROOM DEAL.

READ THAT AGAIN….SENATOR RICK BRATTIN REMOVED JOE NICOLA’S COUNTY (JACKSON COUNTY) FROM THE BILL ENTIRELY. THEN, HE PUTS OUT A VIDEO TAKING CREDIT FOR PUSHING FOR REAL ESTATE TAX RELIEF FOR ALL MISSOURI. This is the same guy who allowed a severability clause to that bill, and we are fairly sure how that is going to end.

This post will be another form of “SEE, WE TOLD YOU SO” when this does happen.

Two days later it was announced that Senator Brattin was resigning as the chair of the Freedom Caucus in the senate…which only has four members just so you know. It is a title and a joke for the most part. It sounds important, but when you review the votes of the FC is tells you that it is a nothing burger. The horrible votes that have been taken all year and the lack of any of those senators willingness to stand and filibuster bad bills shows us who they really are.

Read more about how Former Senator Bill Eigel felt about Rick Brattin’s vote here:

Rick Brattin, in wanting to take credit for tax relief for Missourians by taking that issue from Joe Nicola, rushed to negotiating a very bad bill. Due to his haste, and what many predict will go down in the courts due to the severability clause that he appeared to allow on SB3 in his negotiations, he was forced to resign as the Chair of the four person Freedom Caucus in the senate.

Brattin had been a strong opponent of funding stadiums in the past. Until he wasn’t.

Here you will see where he made a press release on behalf of the Missouri Freedom Caucus on May 29, 2025 committing to fight corporate welfare. What happened to Rick Brattin and his “HARD NO”?

WE HAVE QUESTIONS: Why was the exact language for the senior tax freeze not matched in Brattin’s substitute version offered without Nicola’s help at 2:00 am? Did Brattin go rogue? This senior tax freeze bill, SB 756 from 2024, left us a road map of how to do a tax freeze. Strange that the exact language offering a credit to ALL counties was not replicated in SB 3. Only counties whose senators asked to have their counties represented.

SENTOR JUSTIN BROWN HAS MISSED ALMOST HALF OF THE SESSION THIS YEAR AS IN HE IS NOT THERE AT ALL. HE WAS NOT THERE TO ADVOCATE FOR HIS COUNTY TO BE A PART OF SB3. How is that fair to them?

Some senators are known to be drunk going into late night session events. Why is it fair that those counties whose senators may not have been sober enough to ask to be included be left out?

This is why is it likely going to be ruled un Constitutional. The provision for ALL COUNTIES to be allowed to take this to a ballot initiative was not included.

LINE 34…ANY COUNTY…ANY county…ANY (meaning not just offered to a few, but all) has the license to either pass an ordinance to freeze senior citizens taxes with A BALLOT MEASURE.

Why, having just passed this last year, was this not a reference point for what to do to address taxation in each county giving each county the ability to decide whether they participate in a tax freeze, or not.

FOR THE RECORD: WE DO NOT SUPPORT A TAX FREEZE ON A PER YEAR BASIS AS DIRECTED BY THE STATE. WE SUPPORT THE INDIVIDUAL, ELECTED, ASSESSORS BEING IN CONTROL OF WHAT ASSESSED VALUATIONS SHOULD LOOK LIKE.

The senate knew how to do it. Why did they make it more complicated, leaving out some counties while including others?

This is unconstitutional. THEY LIKELY KNEW IT. As a result this part of this bill will be severed. It was only a show piece so senators like BRAD HUDSON, JILL CARTER AND RICK BRATTIN COULD FIND POLITICAL COVER FOR THEIR BAD VOTES ON THIS BILL AND GO HOME AND DECEIVE THEIR CONSTITUENTS INTO BELIEVING THEY HAD NO CHOICE, BUT TO VOTE FOR THIS BILL. It is all the talk of Jeff City. EVERYONE knows the severability clause was added so the stadium funding would be left alone, while the tax relief for all Missourians on their real estate taxes could be stripped from the bill.

Had everyone believed it to be legal they would have added the non severability clause that would have made them take it all or throw it all out. That would have been a 2:00 am signal that they got it right. But, it was as if they knew it was flawed so they added that severability clause.

THEY COULD HAVE WAITED UNTIL MORNING TO HAVE ATTORNEYS OUTSIDE OF THE BUILDING REVIEW THE BILL. THERE WAS NO RUSH. THEY COULD HAVE DONE MORE TO PROTECT THE CITIZENS OF MISSOURI. BRATTIN, CARTER, AND HUDSON PLAYED THE GAME. A bill of this magnitude should have never been rushed and passed in the wee hours of the morning when the rest of the world is asleep. But, they did not do that.

Instead they went home and told their constituents that had to pass this bill with massive corporate welfare to help their constituents. This is called “political cover” for a very bad vote. Without their votes this bill would not have passed. THEY WENT HOME AND SAID THEY HAD NO CHOICE BECAUSE THEY HAD TO TRY TO FIND RELIEF FOR THEIR CONSTITUENTS DUE TO THE MASSIVE TAX INCREASE HAPPENING ALL ACROSS MISSOURI RIGHT NOW WITH REAL ESTATE TAXES DUE TO THE HEAVY HAND OF THE MISSOURI STATE TAX COMMISSION. THEY COULD HAVE FIXED THIS. THEY DID NOT EVEN TRY.

IF you have not read about that read more here:

TAXES: Why is Governor Mike Kehoe's administration pushing for TAX INCREASES statewide on real estate, but plans to give "tax credits" to billionaires to build new stadiums the citizens will pay for?

Thanks for reading Shield’s Substack! Subscribe for free to receive new posts and support my work.

HERE IS THE FINAL VOTE ON SB3. Without the votes of Carter, Hudson, and Brattin this bill would have failed. READ THAT AGAIN…HAD THOSE THREE SENATORS VOTED AGAINST THIS HORRIBLE BILL IT WOULD HAVE DIED. Did any of them even question the severabality clause added in the wee hours of the morning on the third version?

Ask them at the town halls and picnics when you see them in coming weeks.

This is going to the courts. WE all know it. They likely knew it too, but political cover…this is who they have become. #traitors

WHAT DID THEY DO TO JOE NICOLA?

First watch this video from Joe Nicola on the events of that night they rushed this bill in order to get the stadium funding done.

HERE IS A SUMMARY THE MORNING AFTER THE “VOTE” ON SB3: (click to watch)

To understand that Senator Rick Brattin negotiated Joe Nicola’s own county out of the final version of the bill, and then he took credit for “tax relief” for all of Missouri is wrong. But, that is what happened.

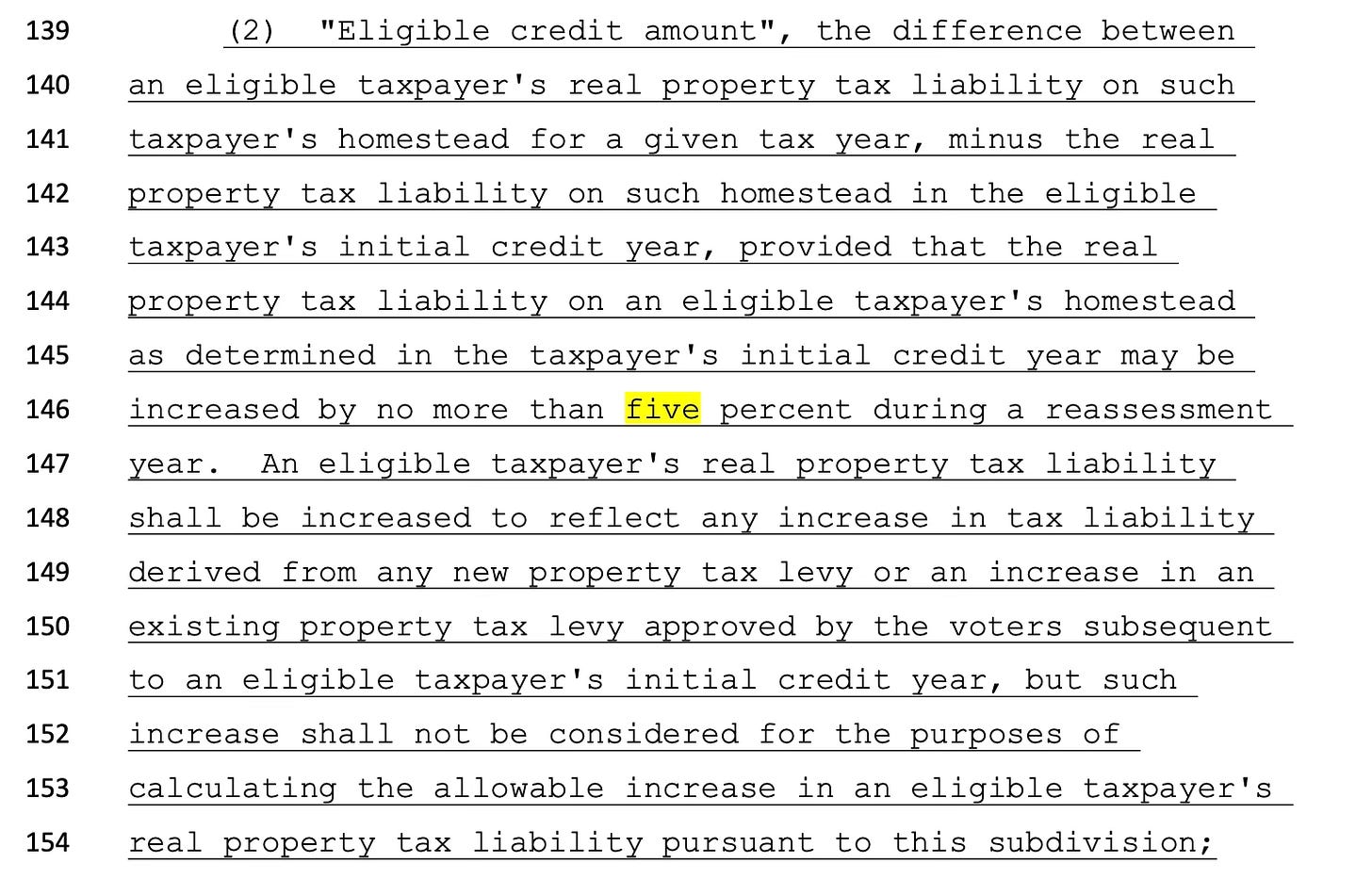

NICOLA’S VERSION CAPPED INCREASES TO 5% EVERY ASSESSMENT YEAR (every two years).

NOTE: EVERY ASSESSEMENT YEAR MEANS EVERY TWO YEARS. A 5% increase cap every two years.

BRATTIN’S VERSION THAT ACTUALLY PASSED: COUNTIES CAN INCREASE 5% EVERY YEAR, OR BY USING CPI WHICHEVER IS GREATER.

Why could he not negotiate for 5% every assessment year or CPI whichever is LOWER? Words matter and the use of words here are not a net positive for the people.

What would be a strong negotiating position would include if the senate wanted to take meaningful action here? Simple.

Not allowing for the Missouri State Tax Commission to subject county assessors to INTERNATIONAL STANDARDS FOR ASSESSMENT.

NOT ALLOWING THE STC TO FORCE ELECTED ASSESSORS TO SIGN AN MOU OR THEY WILL SEE THEIR COUNTIES STRIPPED OF THEIR SALES TAX.

Let county assessors represent the people they were elected to represent.

SHUT DOWN the heavy hand of the State Tax Commission with legislation. It is not hard. NONE of this has even been part of the conversation, thus here we are.

5% caps are not the answer. Restoring power back to our elected assessors IS THE ANSWSER with caps no more than 1% every 10 years for people residing in their homes. All new sales or new construction would be taxed according to the local assessors decision. Maybe that would be better…for starters. This would protect us from the unrealized gains of allowing the Missouri State Tax Commission to force assessors to increase taxes based on INTERNATIONAL STANDARDS OR THEY WILL BE PUNISHED BY THIS AGENCY THAT ONLY HAS THE POWER GIVEN BY THE MISSOURI LEGISLATURE.

(MUCH MORE ON THOSE TOPICS COMING UP).

Share this post and others, then subscribe.

Do your own research. VERIFY FIRST and trust later.

Ask intelligent questions at the summer town halls and BBQs. Do not allow yourselves to be deceived. There is always much more to what you are being told. Largely if a politician in Missouri has their lips moving right now it is a good guess they are lying. A half truth is a whole lie.

Share this post