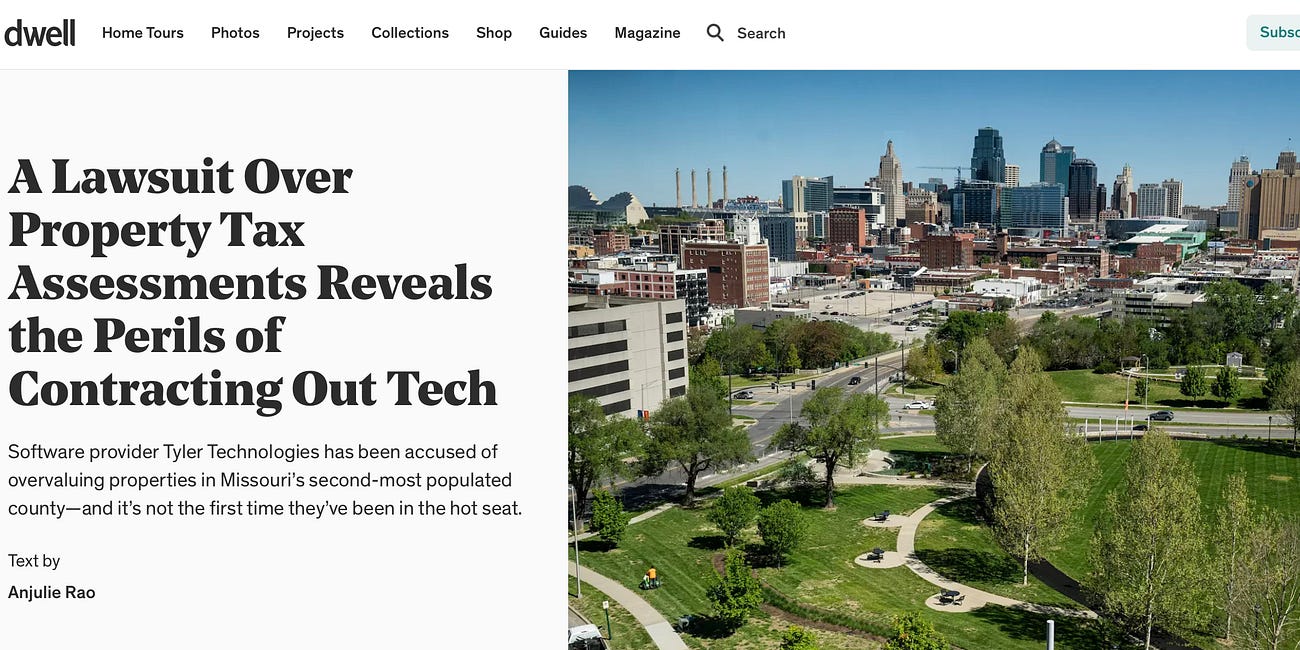

So many Missourians are seeing their real estate taxes increase rapidly. Why?

Because of your current Governor, Mike Kehoe and the authority he holds over his administration are leading the charge to raise your real estate taxes while he demands a special session of the Missouri Legislature to give corporate welfare to BILLIONAIRES to build stadiums in Missouri. He has the power over his administration to advocate for we the people. Why does he constantly choose billionaire priorities over those of hard working Missourians?

What has gone on? The State Tax Commission invited over 70 elected assessors to Jefferson City during the winter of 2025. They handed Missouri assessors an MOU (memorandum of understanding = a contract) with the majority of them feeling they had no other option other than to sign it. Why? Because if they did not sign it and commit to raising taxes in their counties, the STC (State Tax Commission) vowed they would withhold sales tax from each county that refused to sign the STC’s contract.

SO MANY QUESTIONS: IS THAT EVEN LEGAL? DOES THAT FALL UNDER THE AUTHORITY HELD BY THE STATE TAX COMMISSION? DOES THAT FEEL LIKE EXTORTION? HOW CAN THE MISSOURI STATE TAX COMMISSION PROMISE TO DO DAMAGE TO A LOCAL COUNTY FINANCIALLY BY WITHHOLDING THEIR SALES TAX UNLESS THE ELECTED ASSESSOR COMMIT BY CONTRACT (MOU) TO RAISE HIS/HER CONSTITUENTS’ TAXES?

How do we know this? We were told by more than one assessor as we traveled the state doing our round tables during the winter. ASSESSORS ACROSS THE STATE ARE UPSET. THEY FEEL THE STC NEEDS TO BE REIGNED IN. WHAT THEY ARE FORCING ASSESSORS TO DO IS WRONG, AND HAS THE REAL POSSIBILITY TO ASSESS PEOPLE OUT OF THEIR HOMES IF SOMETHING DOES NOT CHANGE. Missouri Assessors felt they had no choice. One assessor was particularly stressed due to the pressure being applied to raise the taxes on Ag and small farms in his county. We also have copies of the MOUs and a diagram that accompanied those MOUs from the STC. HERE IS WHAT THEY LOOKED LIKE:

“THE PLAN”

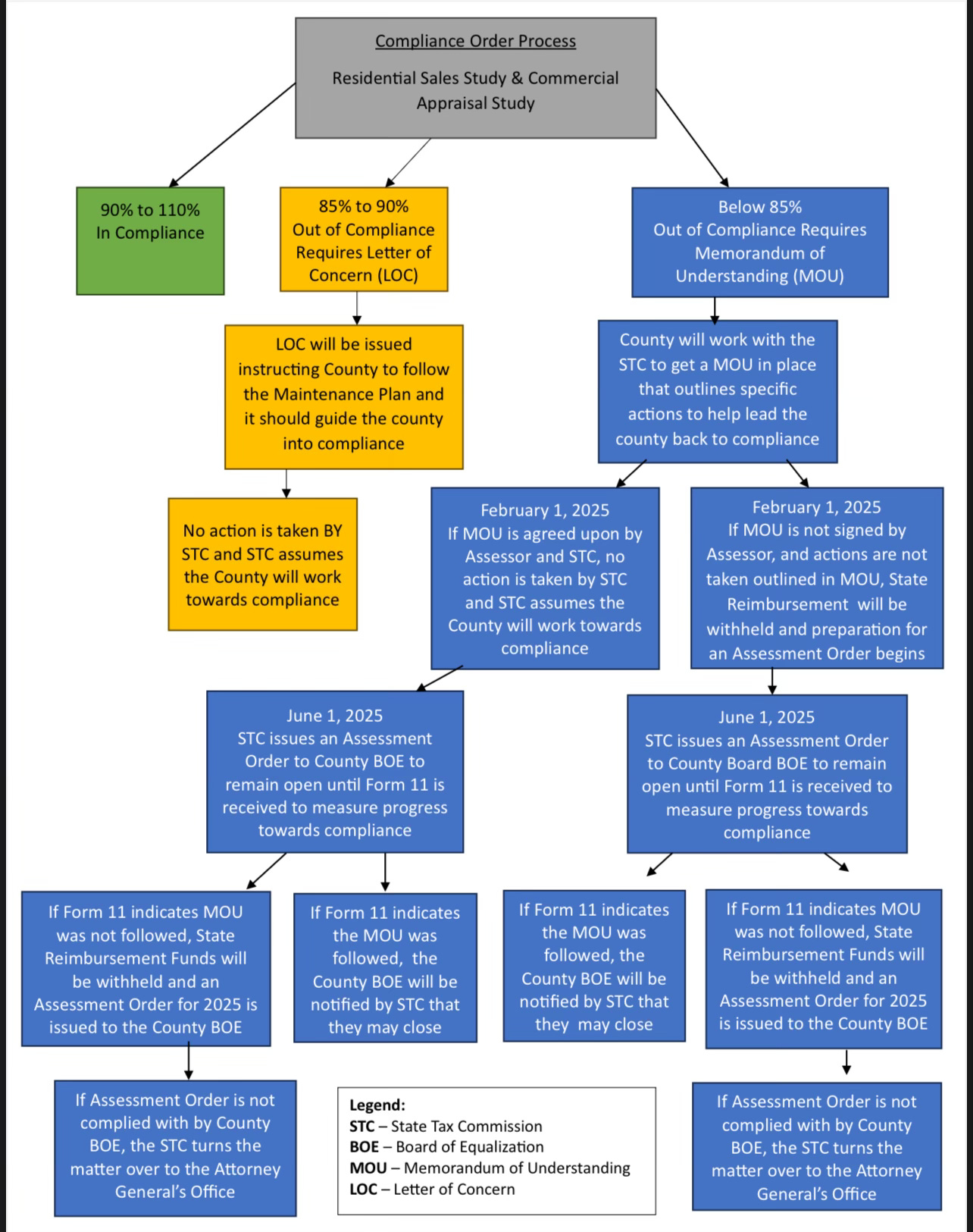

FLOW CHART ATTACHED TO THE MOU FROM THE STC:

Note that the MOU does not mention the threat of withholding the sales tax from counties if the elected assessors do not comply…but, the flow chart attached by the STC certainly does.

Why are we concerned?

From the article by the Missouri State Tax Commission linked below by the Daily Journal: (click photo to read full article)

QUOTE:

“This past year, we had 74 counties that fell short of achieving the required ratio for compliance, which is the most in recent memory. Some were as much as 30% to 40% below market value.”

QUESTION:

How does the STC even know this to be true? What “accurate” data do they have to make such a bold statement? Missouri is a closed record state. This means that local boards of realtors do not share their sold data with the assessor or the counties.

In Missouri this information is privately held.

So, how do the sources used by the Missouri State Tax Commission get their data and how do they know such data is absolutely accurate?

Do they know values in each county better than the elected assessors of those counties? How? Are they using artificial intelligence to “help” assessors “equitably” assess in their counties as has been used in Jackson County, MO?

ALSO: Will we see 15% increases every two years to real estate taxes to catch up to those 30%- 40% deficits noted by the STC? Are these tax increases just the beginning?

QUOTE:

“According to Article X, Section 14 of the Missouri Constitution, we are mandated to ensure the ‘fair and equitable’ taxation of property for all citizens across the state. One way we ensure this is by requiring the county’s property assessment to comply with IAAO standards.”

Again, the STC if forcing our ELECTED ASSESSORS TO SUBMIT TO AN NGO AND THE STANDARDS THE NGO HAS DETERMINED TO BE “FAIR”.

QUESTION:

Fair and equitable? What does this mean when interpreted by the Missouri State Tax Commission? Fair and equitable as determined by whom?

It would appear this means a significant increase in the majority of Missouri property owners assessed valuations.

Who determines what “fair and equitable” looks like? The IAAO?

QUOTE: In the past few months, many counties have received Memorandums of Understanding (MOUs) from the State Tax Commission (STC) requiring the county assessor to raise the assessed values on property to come into compliance with Missouri law and with the International Association of Assessing Officers (IAAO) standards adopted by the STC. We are writing to explain the ramifications of these MOUs and its impact on taxpayers.

UNDERSTAND THIS PART:

“and with the International Association of Assessing Officers (IAAO) standards adopted by the STC.”

The IAOO is a NON GOVERNMENTAL ORGANIZATION (NGO). They provide continuing education as mandated by the state to your assessors statewide. This is much like the Missouri School Board Association that indoctrinates newly elected school board members in Missouri because they are forced to be “educated” by liberal NGOs such as the IAOO. The Missouri School Board Association also lobbies for laws that are injected into school districts by policies that they advise on. It is a twisted structure that is failing the people of Missouri. The IAOO is not different.

“ADOPTED BY THE STC”: They are not elected. They are an appointed commission that has far too much power. THEY ADOPTED THE “IAAO STANDARDS” WITH THEIR 3 PERSON VOTE.

The Missouri State Tax Commission serves at the pleasure of the Governor. They are appointed to reflect the values and goals of the Governor in Missouri. Review the resources we will submit here and decide for yourself what is going on and if this is who you thought you elected to represent Missouri’s values.

The STC is comprised of THREE INDIVIDUALS: (click to read their names and bios):

FORMER SENATOR GREG RAZER, STC COMMISSION: ** (Appointed by REPUBLICAN Governor Mike Parsons):

Take a look at the links in this article. Is Greg Razer FOR higher tax rates on real estate in Missouri?

WHAT DOES COMMISSIONER RAZER FEEL IS FAIR AND EQUITABLE WHEN IT COMES TO BURDENSOME TAX INCREASES ON MISSOURI?

He certainly does not embody the majority of Missourians when it comes to his definition of what Diversity Equity and Inclusion means.

Does that spill over into his job as a state tax commissioner? We are not sure, but it is a good question.

HOW IT STARTED:

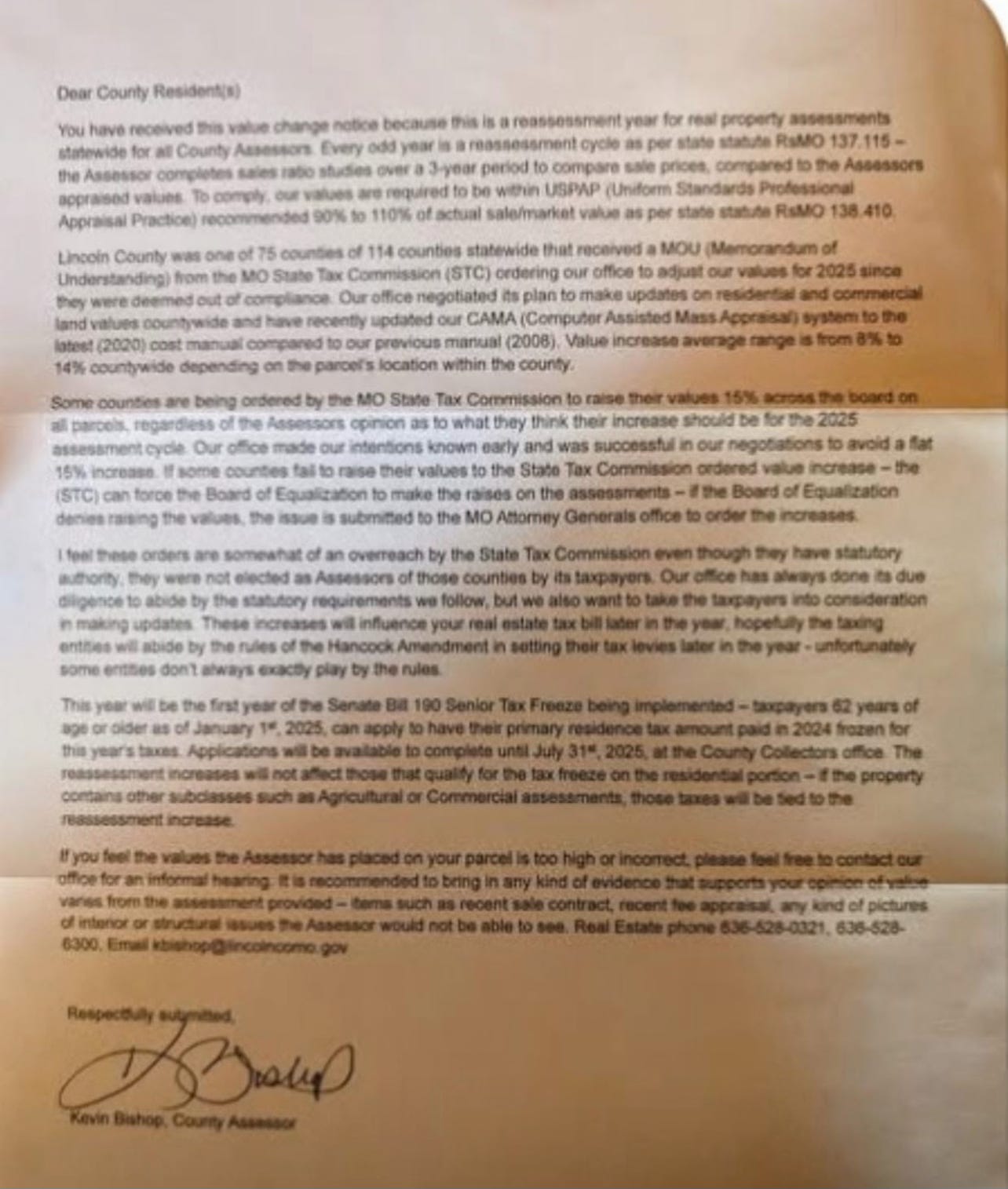

LETTER FROM STC TO ELECTED MISSOURI COUNTY ASSESSORS (one shown below):

CONNECTING DOTS:

The STC forces counties that are undervaluing real estate in their counties to adopt the IAOO STANDARDS VOTED ON BY THE THREE MEMBER STATE TAX COMMISSION.

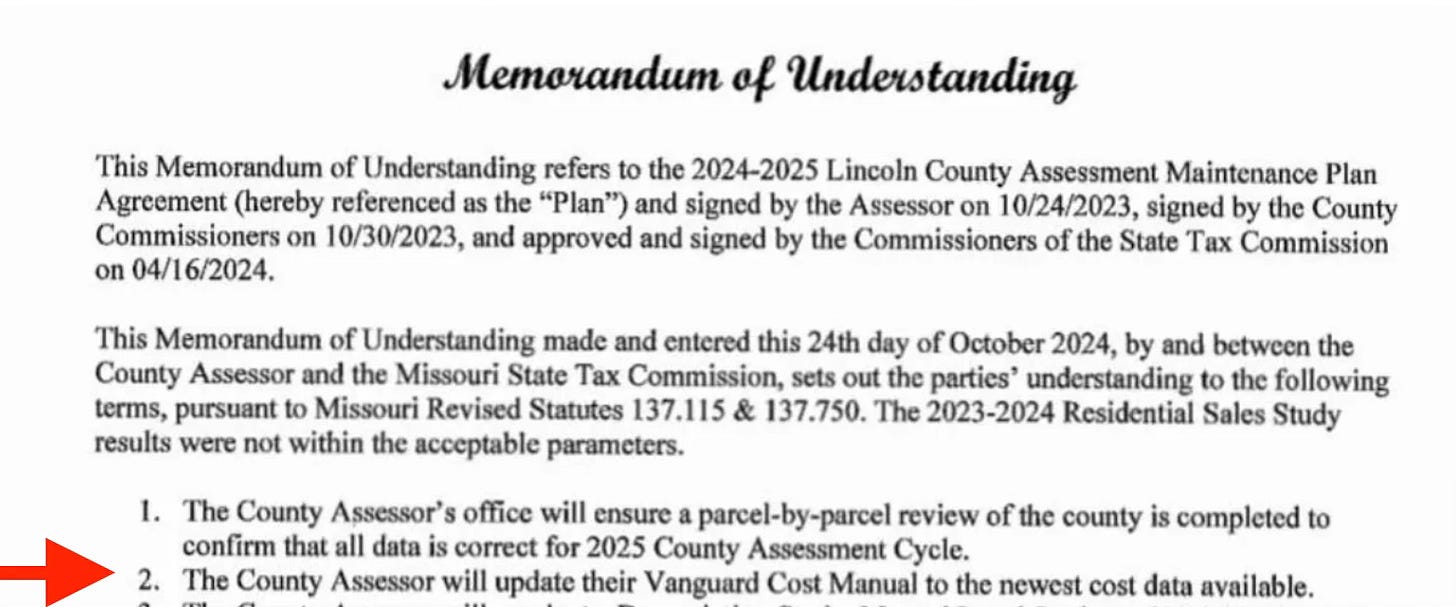

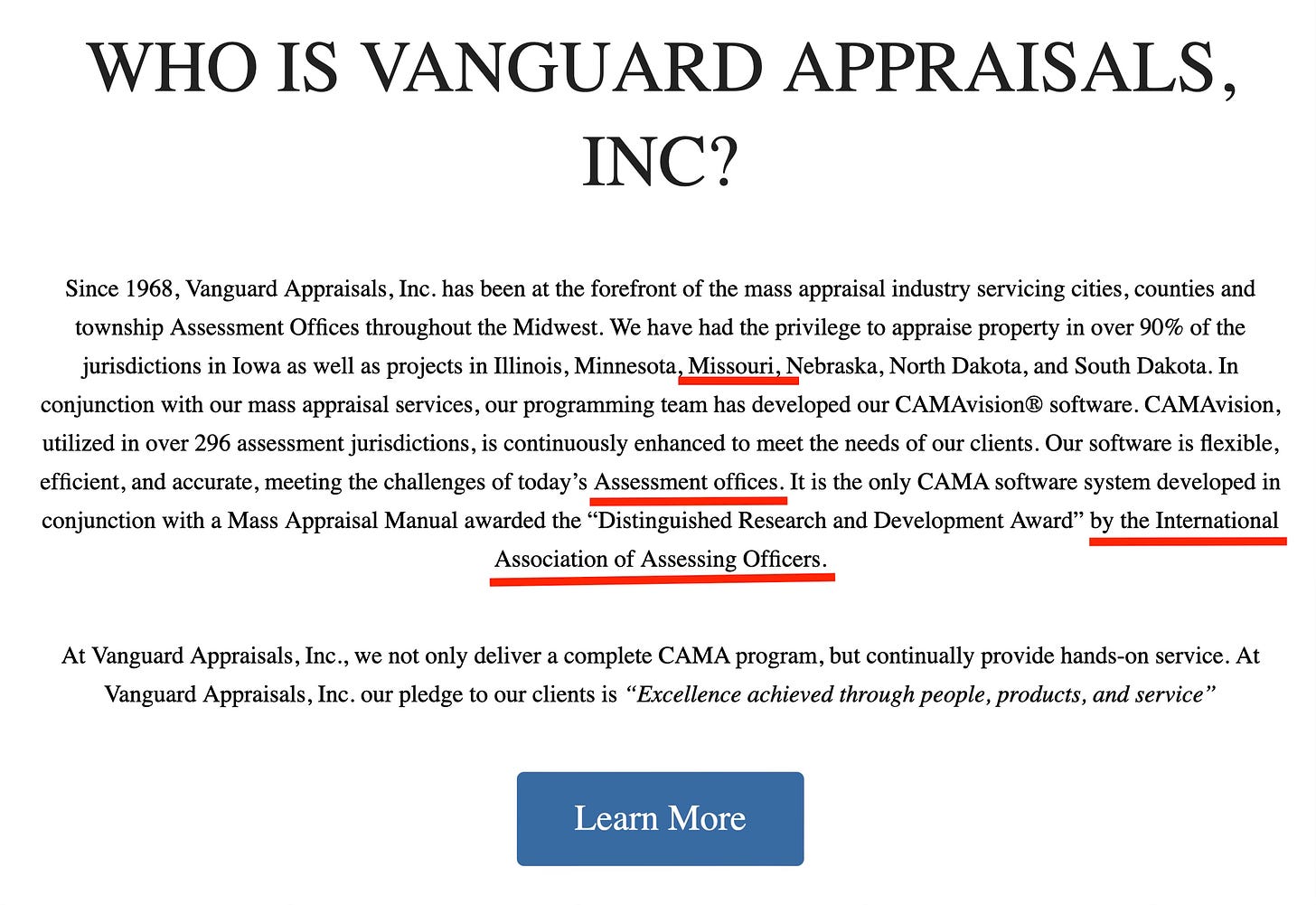

IN THE MOU SHOWN ABOVE, THE STC TAX COMMISSION FORCES ALL COUNTIES TO USE THE “VAN GUARD COST METHOD”.

SEE #2 of the MOU (which is another word for a contract) as shown below.

WHO IS VANGUARD?

A private, FOR PROFIT, corporation:

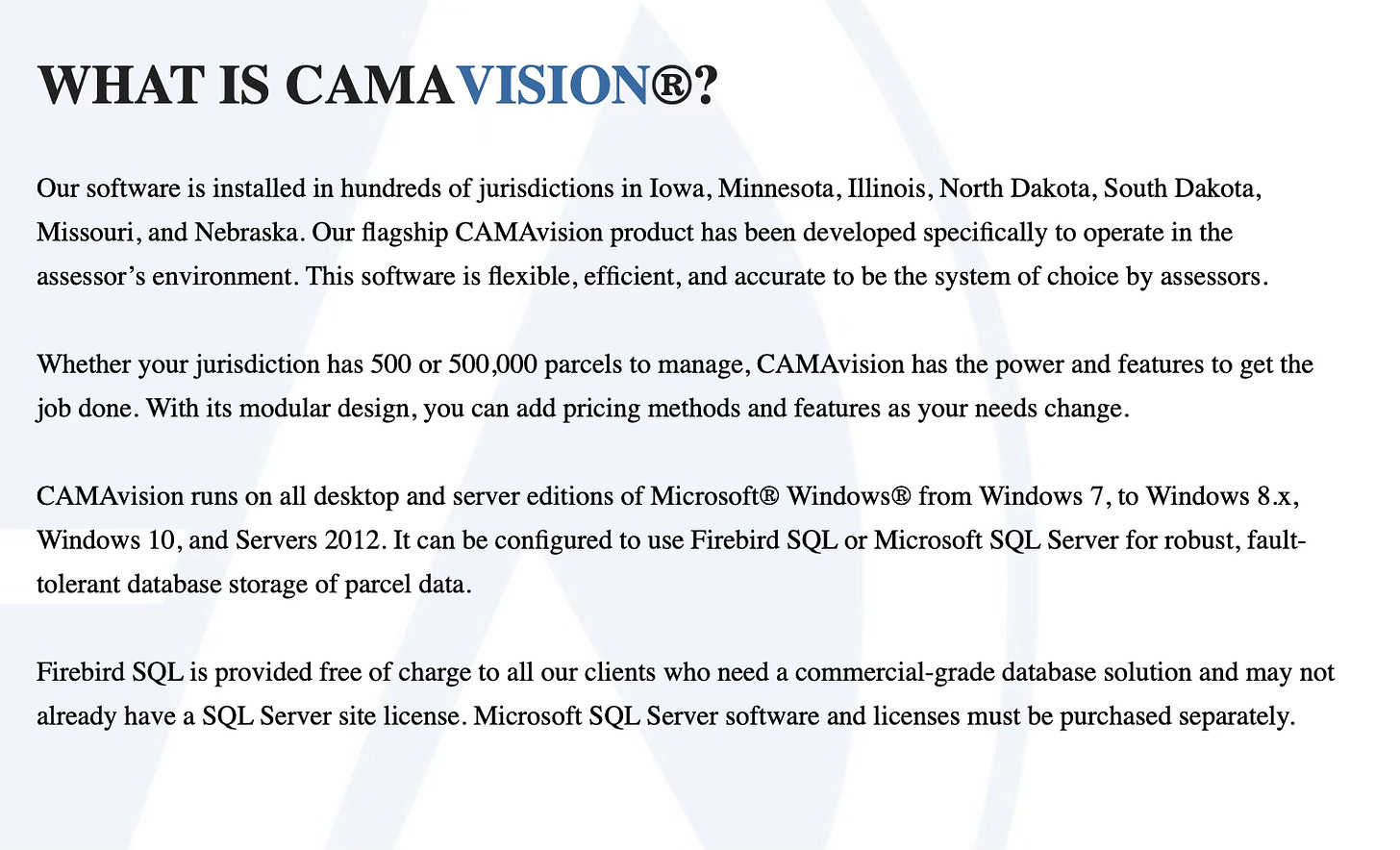

WHAT IS THE CAMA system of assessment?

QUESTIONS: VANGUARD IS THE OWNER AND DISTRIBUTOR OF SAID SYSTEM. IS THIS GOVERNED BY ARTIFICIAL INTELLIGENCE? HOW WOULD AN ASSESSOR EVEN FIGHT THIS COMPUTER GENERATED ASSESSMENT OF REAL ESTATE IN THEIR COUNTIES? WHY IS THIS TOOL ACCEPTED AS ACCURATE? ARE OUR COUNTIES HIRING VANGUARD APPRAISERS TO COME AND DO PHYSICAL ASSESSMENTS OF PROPERTY IN YOUR COUNTY?

Assessors are saying that in order to increase taxes beyond the 15% there has to be a full inspection of a property. Is this how it is being done? DEFINE a “physical inspection” if people are not allowing these “assessors” into their homes.

NOTE THE PORTION OF THE LETTER BELOW THAT REFERENCES CAMA VENDOR (also for a price) $$$.

From the letter sent to the Missouri Assessors below:

Do you see how the Missouri State Tax Commission is making these vendors rich by mandating compliance by using these “tools” as approved the NGO (the IAAO) Standards:

This is the letter sent to one of the Missouri’s Assessors below:

The Missouri State Tax Commission says The IAAO:

“In the past few months, many counties have received Memorandums of Understanding (MOUs) from the State Tax Commission (STC) requiring the county assessor to raise the assessed values on property to come into compliance with Missouri law and with the International Association of Assessing Officers (IAAO) standards adopted by the STC.”

SO…the THREE Commissioners of the STC have adopted the “standards of the IAAO” and forced those “standards” upon all of Missouri’s elected assessors …OR ELSE THEY WILL BE PUNISHED BY WITHHOLDING THE VERY TAXES THAT KEEP THOSE COUNTIES WORKING.

Let’s take a look at this NGO Called the IAAO:

How fun. If your elected assessor is a part of the IAAO, the Annual Conference is in Florida this year. A great way to get a vacation paid for by tax payers to attend a conference that promotes a global agenda.

Also the IAAO will define for your assessor what is “FAIR AND EQUITABLE” when it comes to your assessed valuation that is tied to your real estate taxes.

NOTE THE LANGUAGE IN THIS ARTICLE…they highlight the COVID PANDEMIC as the start of the new valuation model. Is this what equity and DEI is assessing valuations look like under the mandated standards imposed by the Missouri State Tax Commission as they force those IAAO standards upon every assessor in our state?

Does this make you feel better knowing that the IAOO (whose standards the Missouri State Tax Commission has signed onto) embraces and fully promotes DEI?

Didn’t Governor Mike Kehoe sign an Executive Order banning DEI in Missouri Government? HE DID.

Well, someone needs to tell the State Tax Commission that they IAAO is not following this executive order issued by our Governor. WAS HE BLUFFING? OR DID HE MEAN WHAT HE SIGNED?

GOVERNOR MIKE KEHOE NEEDS TO HALT ANY RELATIONSHIP WITH THE IAOO if he means what he actually says:

THIS FROM THE IAAO WEBSITE:

“As a global community of diverse mass appraisal professionals, we can best fulfill our mission and vision by ensuring all individuals experience an equitable, inclusive IAAO environment. We incorporate DEI principles and practices into our goals of professional development, community engagement, communications and advocacy, and business innovation. To sustain this commitment, we implement meaningful metrics and measures.

A diverse, equitable, and inclusive IAAO will continue to serve as a leader in making the assessment industry more reflective of the communities we serve.”

LOOKS A LOT LIKE FEMA UNDER THE BIDEN ADMINISTRATION AND HOW THEY DEFINED HOW EQUITY AND FAIRNESS WOULD BE DISTRIBUTED TO THOSE WHO PAID INSURANCE FOR RELIEF. THERE WAS A NEW MODEL ADOPTED THAT DEFINED EQUITY IN THAT FEDERAL DEPARTMENT: (read about that here:)

Is there such a thing as “assessing equity” under the IAAO GLOBAL POSITION ON DEI? Sure looks like it. This is a globalist thing, most certainly.

Here is what that looks like: IAAO is pushing for the “GLOBAL PROPERTY CONGRESS” which advances the “WORLD ASSOCIATION OF VALUATION ORGANIZATIONS” and the “INTERNATIONAL VALUATION STANDARDS”.

“GLOBAL PROPERTY PROFESSIONALS (IAAO INCLUDED) TO SHAPE THE FUTURE OF THIS SECTOR.”

WHAT DOES THAT MEAN?

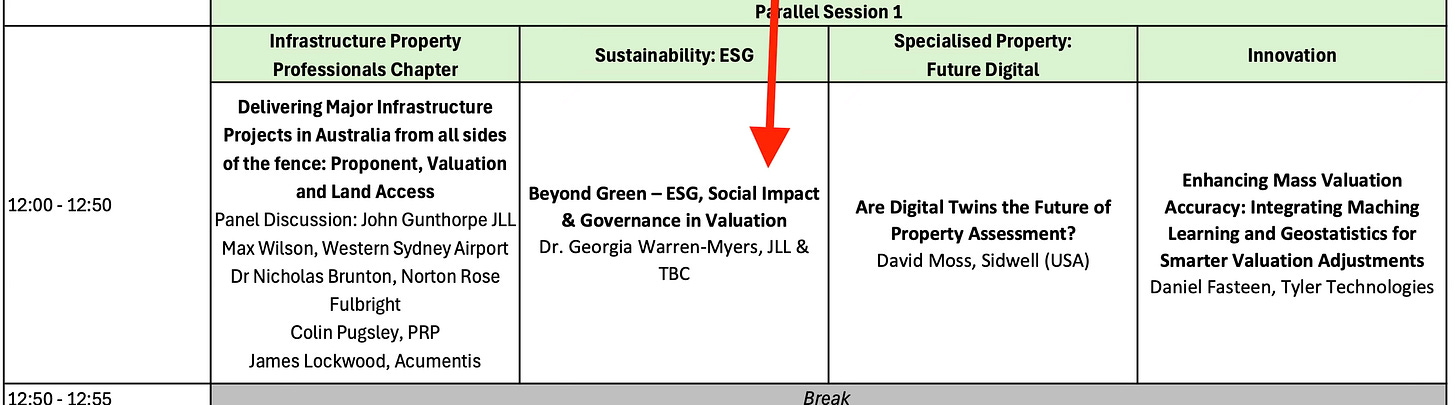

TAKE A LOOK AT THEIR AGENDA:

You see this, right?

Missouri State Tax Commission endorses and forces all Missouri County Assessors to follow the IAAO “standards” for assessment.

The IAAO is a part of a much bigger picture called the Global Property Congress that is having their annual conference in Australia in May of 2025.

That agenda is absolutely clear: (click any of the above photos to see the speakers and what the agenda is here.)

Climate Change

ESG

Artificial Intelligence

Water valuation

Sustainable = United Nations Agenda 21 & Agenda 2030

Lastly, WHO, EXACTLY, IS VANGUARD APPRAISALS AS MENTIONED IN THE ABOVE LETTER FROM THE MISSOURI STATE TAX COMMISSION?

AHHHH, they were given an “award” by the IAAO. Did you see that?

So…the STC says all Missouri Assessors MUST FOLLOW THE IAAO Standards to stay in compliance, then we see that VanGuard has received an award from the IAAO. Makes you wonder who is making big money off of this partnership, doesn’t it?

THEY ARE IN THIS TOGETHER, MAKE NO MISTAKE. THIS IS ABOUT A MUCH BIGGER AGENDA THAN MOST UNDERSTAND. THIS IS GLOBAL.

SO…the GLOBAL PROPERTY CONGRESS PARTNERS WITH THE IAAO.

QUESTION:

What are the IAAO Standards?

Every elected assessor in MO is required to attend a “continuing education course” on how to be a good assessor. This is mandated by law. (Which is a ridiculous law. Every elected official is now subject to this kind of indoctrination due to the legislature passing ridiculous laws requiring this). The IAAO just happens to provide these education courses to all Missouri Assessors (for a fee) and encourages membership (for a fee) in their organization.

See more here about the IAAO:

https://www.iaao.org/membership/

It is an NGO (non governmental organization) that every elected assessor is subject to in MO due to the MO STC adopting their “standards” and then forcing elected assessors to sign an MOU (contract) promising to use those standards, too. If they don’t they will see their sales tax withheld.

Does the STC even have this authority? If they did why the need for an MOU?

It is likely the IAAO standards are driven by AI (Artificial Intelligence). This is considered by our state tax commission to be “fair and equitable”? If this is not the case, then how are the valuations across MO seeing a uniform recommended increase of 15%?

QUOTE:

“This has led us to recommend raising the assessed values in some counties by 15%”.

QUESTION:

Oddly, it is being reported across the state Missouri property owners are seeing 15% or more of an increase in their real estate taxes.

Why are we submitting to standards offered by an NGO using AI to establish valuations rather than trusting our locally elected assessors who have been chosen to represent the tax payers in their districts?

You see what is happening here, right?

Read about the STC’s push to force assessors to raise real estate taxes state wide here:

https://dailyjournalonline.com/2025/04/02/state-tax-commission-explains-assessors-reassessment/

Note: The heat has been turned up under the Kehoe admin. Take note of the dates.

Ask your assessor if your tax increase was as a result of an MOU he/she signed.

Most likely it is.

We do NOT want AI assessing our properties. We also do NOT want the state tax commission’s definition of “fair and equitable” raising our taxes to a standard set by some NGO. Our elected assessors should be doing that. Why even have elected assessors if they are being forced into uniform compliance by our state bureaucratic agency called the STC? Our state is being driven into uniform/standardized “standards” of taxation established by an NGO given the power by our state to do so.

WE DO NOT WANT TO BE FORCED TO ADOPT STANDARDS THAT MANDATE AN NGO’S STANDARDS (THE IAAO) THAT ADHERE TO A GLOBAL AGENDA THAT DOES NOT ALIGN TO MISSOURI VALUES.

Crazy, right? Do your own research. We have given you enough information here to start.

Reminder: the State Tax Commission (STC) does not have this kind of power over your assessor unless the elected assessors gives it away by signing a contract. This is why they forced the MOUs. They had to have the contract to force compliance.

Also, do not forget that your Republican Governor Parsons appointed the most radical Democrat in the senate to the STC before leaving office. Razer was a champion of DEI, Equity, and all radical agenda initiatives that fell under th”Equity” banner. See headlines above.

This is where we are headed under the current State Tax Commissioners forcing elected assessors to adopt the IAAO’s “STANDARDS”. THEY IAAO has clear and undeniable affiliation with global agendas that should concern us all.

It makes this a little too close to home, doesn’t it?

REMEMBER THIS: THE TAXING OF UNREALIZED GAINS that Kamala Harris talked about?

WHY IS MISSOURI TRYING TO DO THE SAME THING WITH REAL ESTATE TAXES IN MISSOURI? HOW CAN THEY TAX PEOPLE OUT OF THEIR HOMES? THEY PUNISH MISSOURIANS WHO HAVE LIVED IN THEIR HOMES DURING THE TIMES OF UNIMAGINABLE APPRECIATION (that in many places is now making corrections) WITH THE STC blaming the gains that happened over COVID as their push to assess valuations after those crazy property value increases for people living on fixed budgets already being taxed to much in their lives. People in Missouri cannot afford massive tax increases.

Seems like part of a much bigger agenda now.

How is what the State Tax Commission is doing now any different than what Kamala Harris proposed?

If you do not pay the taxes on the home you own and have owned for generations, you will be homeless. The government will take it from you.

HAVE YOUR PERSONAL PROPERTY TAXES INCREASED LATELY, TOO?

Maybe it is because VanGuard is also “assessing valuations” forced on to local assessors in Missouri. Take a look at this:

AND NOW THIS….THE GOVERNOR’S TRUE PRIORITY. IT IS NOT US. IT IS CORPORATE WELFARE FOR BILLIONAIRES:

IS MIKE KEHOE TONE DEAF? JACKSON COUNTY, MISSOURI VOTED DOWN A TAX INCREASE IN THEIR SALES TAXES A YEAR AGO TO BUILD AND FUND THESE STADIUMS:

WHAT IS THE RISK OF ALL OF THE NEW INCREASES FOR JACKSON COUNTY AND TURNING THE REST OF THE STATE INTO A VERSION OF JACKSON COUNTY? READ THE ARTICLE WE DID LAST YEAR BY CLICKING BELOW:

LAND BANKS---THE BILL THAT MADE IT ACROSS THE FINISH LINE IN MISSOURI AND WHY YOU SHOULD PROBABLY WORRY.

JACKSON COUNTY TAXES INCREASE FOR SOME 83% after contracting out assessment to artificial intelligence.

HOW HAS THE STANDARDIZED TAX INCREASE FORCED UPON JACKSON COUNTY WORKED OUT FOR THOSE CITIZENS? READ BELOW:

55,000 Appeals in JACKSON COUNTY, MO after they assessed all real estate using Artificial Intelligence.

NOW, Governor Mike Kehoe’s Administration is pushing to make Missouri into Jackson County after a relentless pursuit of the state tax commission to force county assessor’s state wide to either sign an MOU (Contract) under duress due to the fact the STC has promised to withhold sales taxes from each county if they refuse to sign.

KEHOE IS TONE DEAF. PEOPLE DON’T WANT TO SHOULDER THE BURDEN OF THESE STADIUMS. HE IS NOT LISTENING. HE IS FORCING THE LAW MAKERS TO ADOPT HIS AGENDA WHICH IS NOT WHAT MISSOURIANS WANT OR CAN AFFORD.

START BY HELPING OUT THE REAL ESTATE TAX PAYERS OF MISSOURI.

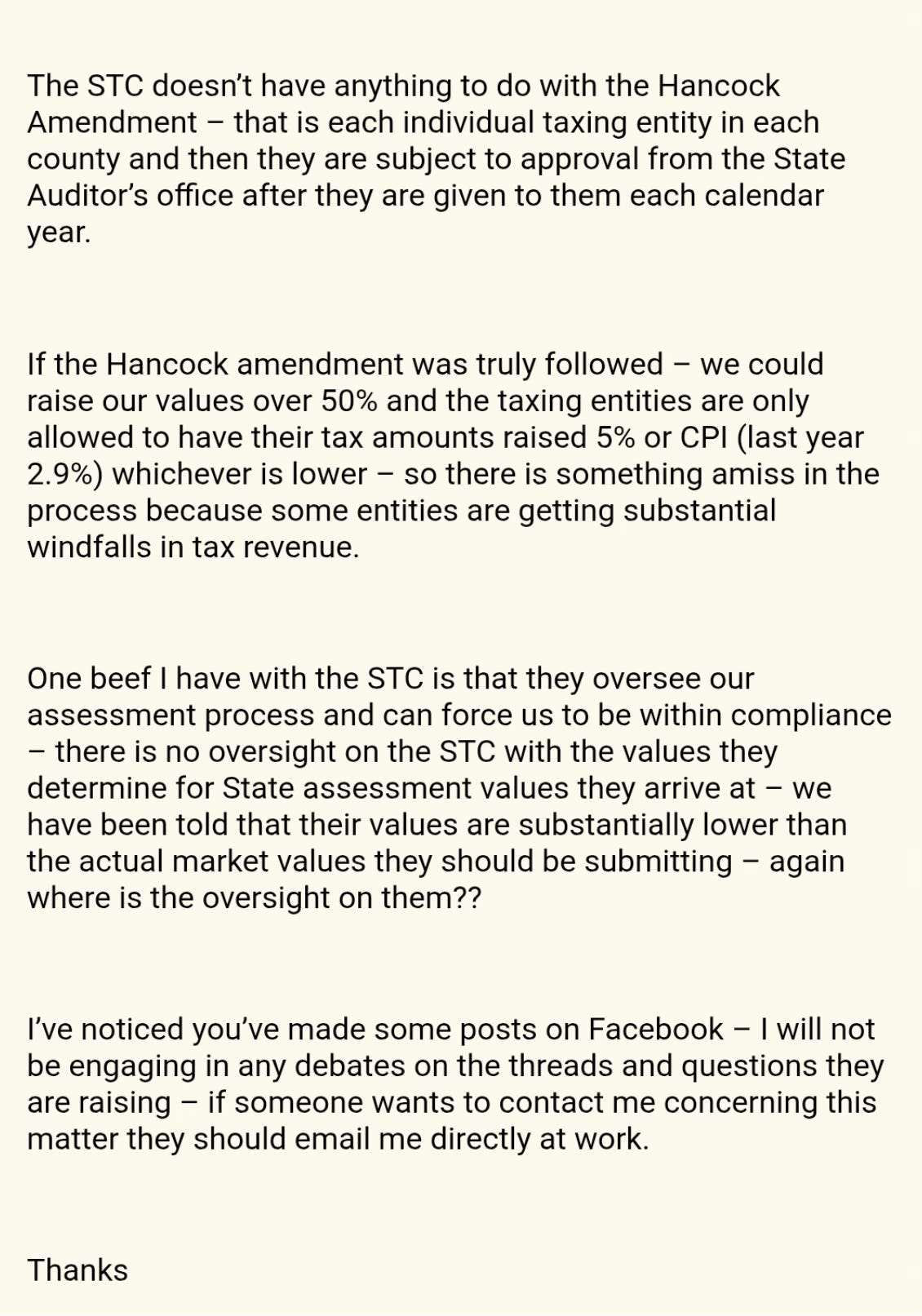

WHAT DO THE ASSESSORS IN MISSOURI THINK ABOUT THESE TAX INCREASES?

COMMENTARY FROM ONE MISSOURI ASSESSOR.

How can they negotiate with the State Tax Commission? Seems like the STC writes new rules as they go, doesn’t it?

ANOTHER MESSAGE FROM ANOTHER MISSOURI COUNTY ASSESSOR:

I LOVE THAT PART…THE STC FORCES COMPLIANCE, BUT WHO IS OVERSEEING THAT THE STC IS ACTING WITHIN THE SCOPE OF THEIR AUTHORITY.

NO ONE IS WATCHING THEM. AND THAT IS THE PROBLEM WE HAVE WHEN THE BUREAUCRACY RUNS OUR STATE. WE BECOME SLAVES TO THE UNELECTED.

ADVICE

If your taxes have increased file an appeal with your local Board of Equalization.

Ask your assessor to show you the method of assessment they are using to assess valuations and ask them to show you.

When they ask for you to get your property appraised, reject that. They need to show you how your property has been assessed and by whom or what computer program.

Ask them to verify that those values are accurate since we are a closed record state.

NEVER, EVER, EVER allow anyone into your home from the government to value your property. NEVER.

SHARE THIS POST.

ASK YOUR ASSESSOR TO STOP SIGNING MOUs THAT FORCE COMPLIANCE WITH THE STATE TAX COMMISSION! This madness has to stop.

Missouri just approved a budget of over $53.5 BILLION. Six years ago when REPUBLICAN Mike Parsons took office as the Governor our budget was $27 Billion. Our Republican leadership has taken us to the gutter with tax credits and political favors to their donors on the backs of hard working Missourians.

Missouri has almost an identical budget to the RADICAL AND LIBERAL state of Illinois with only half of the populations.

WAKE UP MISSOURI, BEFORE YOU ARE TAXED OUT OF YOUR HOMES.

Share this post